Image source: Shutterstock

For those whose children will be taking classes online or participating in remote learning this school year, keeping the following tips in mind will help create an at-home learning environment that prioritizes health and learning, while being able to adjust to this year’s unknowns.

A home cannot fully replace all that a formal school classroom has to offer. However, what it lacks in traditional classroom appeal it makes up for in comfort and familiarity. Prepping your home to take on this additional role will help set your child up for success during what will be a unique academic year for many.

Set the tone

One of the best ways to set your children up for success this school year is to get them excited. It is important to communicate that this school year, even with all its unknowns, is an exciting opportunity for new and creative ways to learn and grow. Helping your child understand the unique learning possibilities your home provides will get the school year off to an enthusiastic start.

Create a space

Establishing a designated space for school at home is important for a child’s ability to focus and to associate a space with learning. How you create a classroom environment will depend on your home and your needs. If your child is most comfortable in their room, try incorporating their classroom setup there. Depending on your child’s age, it may help to have toys or familiar room objects nearby. However, if your child is distracted by their own room, it may be better to set up elsewhere to help them focus, such as a nook or office.

Allowing your child the freedom to make the space their own will help stimulate their imagination, which is vital to their learning and enjoyment of school.

Wherever the home classroom is, be sure that area has minimal distractions, maintains a strong internet connection, and is well-stocked with school supplies within reach at all times.

Back to school

To maintain a sense of normalcy, keep your family’s back-to-school traditions intact this year, such as picking out school supplies, back to school clothes shopping, and everyone’s favorite first day of school photo. These ceremonies of preparation for the school year will build excitement while bringing some familiarity to those final days of summer.

Establish a routine

Just as adults have discovered new routines to parallel the shift to remote work, children need a shift in their daily flow to mirror the change to remote learning. The rigor of their school schedule will determine how much flexibility you have in putting together a routine.

Stay active, incorporating movement breaks throughout the day to make up for the lack of physical activity. Plan out times away from their computer screens to differentiate between work and play time. It’s recommended that children move at least 60 minutes a day, so prioritize exercise and movement, going outside when possible. This change of scenery is a helpful intermission for children. It gives their eyes a rest from their screens and returns them to their learning space feeling refreshed and revitalized.

Granted, your ability to facilitate your child/children’s preparedness and monitor their continued learning is based on various factors like your work schedule and what resources your school district is providing for at-home learning. No matter your household’s situation, taking these factors into consideration where possible will help set your student(s) up for success.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

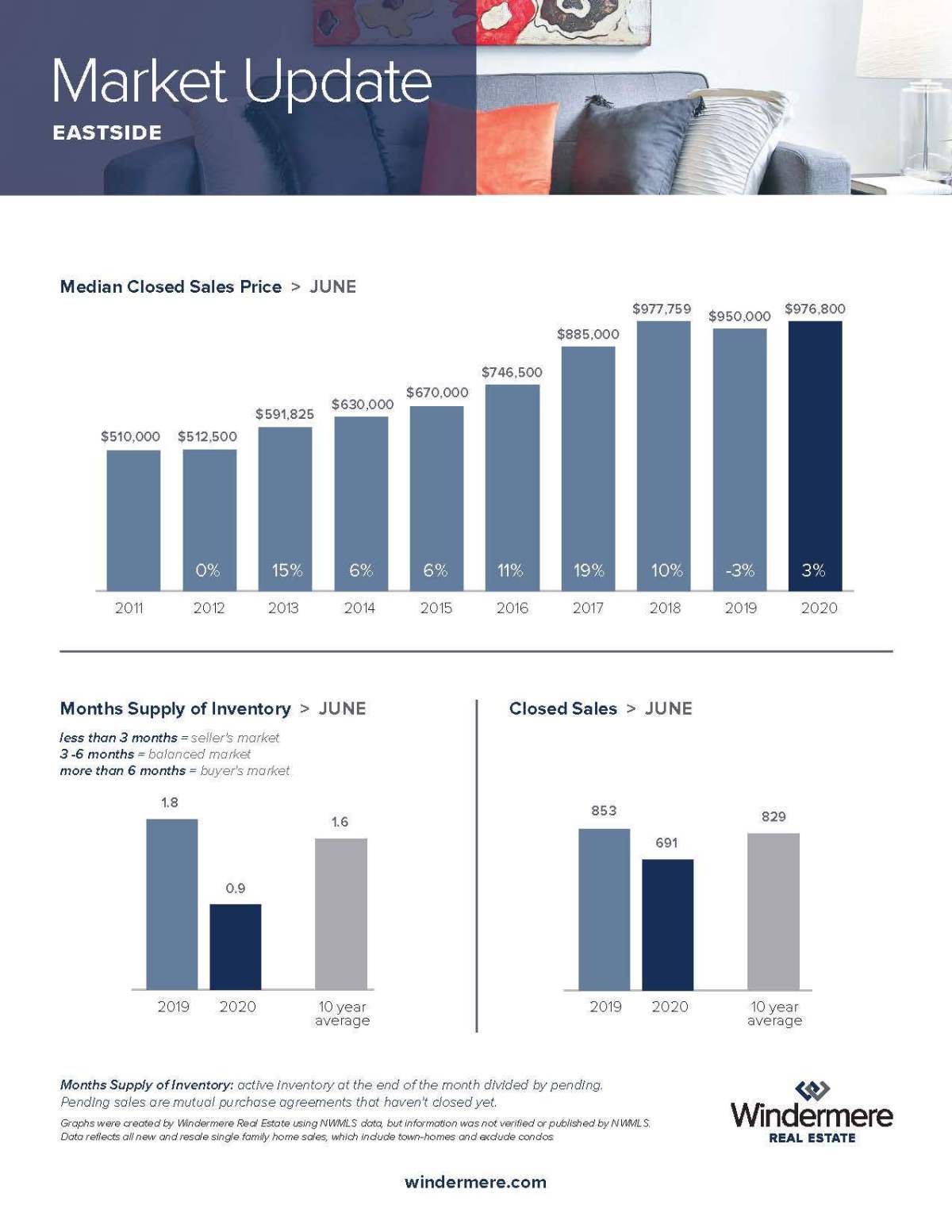

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.